Employee Retention Tax Credit (ERTC) Service

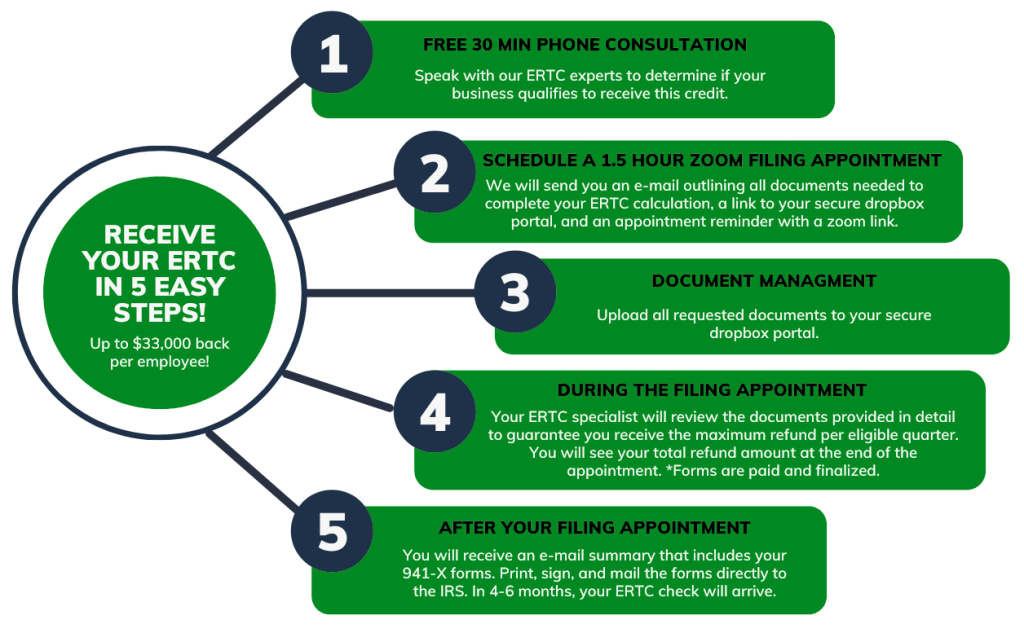

The PayrollSam ERTC Service can help businesses claim the Employee Retention Tax Credit retroactively to March 12, 2020. Your business will receive:

- A specially trained ERTC Service expert to review if qualified wages used

- A report providing full documentation of all calculations

- Preparation and filing of the respective amended returns*

The Infrastructure Investment and Jobs Act ended the ERTC, for most employers, retroactive to Sept. 30, 2021. Recovery Startup Businesses remain able to pay qualified wages through Dec. 31, 2021 to use to claim the credit.

*2020 amended returns from Q2, Q3, and Q4 are due by April 15, 2024, while 2021 amended returns for all quarters are due by April 15, 2025.

Businesses can no longer pay wages to claim the Employee Retention Tax Credit, but they have until 2024, and in some instances 2025, to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

Although the Employee Retention Tax Credit (ERTC) program has officially sunset, this does not impact the ability of a business to claim ERTC retroactively. In fact, businesses can conduct a lookback to determine if wages paid after March 12, 2020 through the end of the program are eligible.

For most businesses, the credit could be claimed on wages until Sept. 30, 2021, with certain businesses having until Dec. 31, 2021 to pay qualified wages.

Businesses have until April 15, 2024, to file amended returns for Q2, Q3, and Q4 of 2020, and until April 15, 2025, to file amended returns for all 2021 quarters.

In addition, several laws have gone into effect since the inception of the ERTC program that impact how the credit can be claimed. PayrollSam has an ERTC Service to assist.

This article highlights eligibility, qualified wages, how the credits work and more. It also delineates by law and date because, depending on whether you took a Paycheck Protection Program (PPP) loan and when you claim the credit, there are different requirements.